There are all kinds of stereotypes about the people who give up their pet to a shelter: They got tired of the dog after it wasn’t a cute puppy any more, or couldn’t be bothered to cut the cat’s nails so it wouldn’t scratch the furniture, or needed a new designer mix to match their handbag. The reality is quite different.

“Forty-plus million Americans live in poverty. They have pets and they love their pets,” said Matthew Bershadker, president and CEO of the ASPCA. Given the American average of 1.8 animals per household, Bershadker estimated that over 25 million cats and dogs are living in poverty, and he noted that 52 percent of the clients of the ASPCA Animal Hospital in NYC are living on less than $15,000 per year.

“We see people often who are in their darkest day,” said Lori Weise of Downtown Dog Rescue in Los Angeles, which is dedicated to helping people keep their pets. “They’re facing some other crisis, and they happen to own a dog.”

Get Talk Poverty In Your Inbox

Weise’s organization finds many people are at the shelter because they’ve run out of options — often because they’ve run out of money — and they aren’t aware of resources to help. In one ASPCA study, 40 percent of low-income pet owners surrendering an animal to a shelter said they would have kept their pet if they’d had access to affordable vet care, and 30 percent said the same if they could have gotten free or low-cost pet food.

There’s a growing awareness that meeting the needs of low-income pet owners is central to the mission of animal rescue. “Everywhere I go, we are either involved in or are talking to people about safety net services,” said Bershadker. “It’s almost as if a few years back a massive light bulb went off in the animal welfare community and we stopped thinking about how to get animals out of shelters and we started thinking about how to keep animals from coming into shelters.”

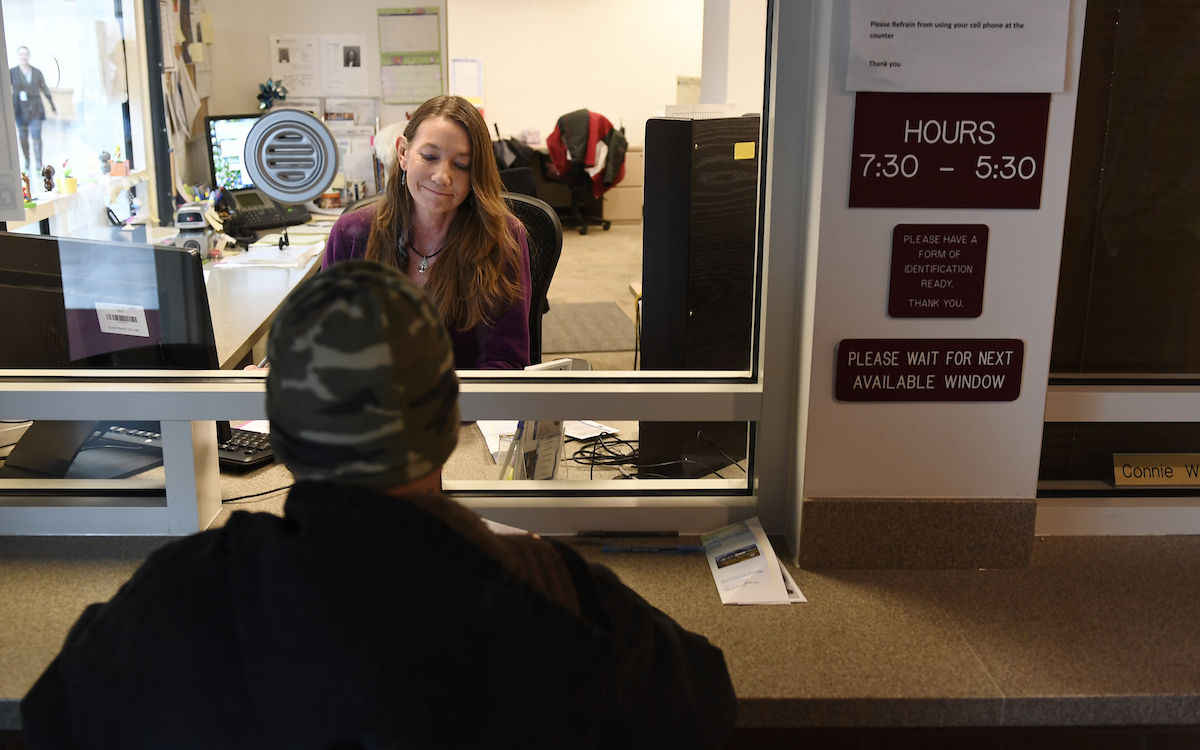

Some programs have, in fact, been working to keep pets together with low-income owners for a while, and the people running them have learned some important lessons about what it takes. Downtown Dog Rescue, founded in 1996, has helped keep 12,000 pets from being surrendered to shelters in south Los Angeles since 2013. They don’t have fancy facilities, just a card table and two chairs outside the shelters they partner with, where they start a conversation with people who may be in a panic.

“They’re crying, bawling, shaking, maybe they have a citation — they’re scared,” said Weise. “I say, ‘if I told you I could help you, would you want to get rid of your pet today?’ And they often say: ‘Oh no, I love him.'”

Once they’ve established that someone would rather keep their pet, the counselors start to connect people to resources: a volunteer handymen that will patch a fence for someone who’s been cited for their dog running loose, low-cost training advice, and crucially, options for lower-cost vet care. In L.A., there are free spay and neuter services for low-income pet owners, as well as vets who provide a discount on services to people working with Downtown Dog Rescue. The numbers needed to help someone keep a pet often aren’t huge — Weise said it generally costs them less than $100. One challenge is often persuading vets to volunteer time and offer discounts. “A lot of them have tremendous amounts of student loans,” said Weise. “The young ones are struggling.”

Weise has found that it’s crucial to make it easy for vets to help. They work with three main animal hospitals, so no one vet is bombarded with cases. They make sure billing is free of complications: Clients show up with written vouchers stating what Downtown Dog Rescue is paying for, and there’s one point of contact for billing the organization. For their monthly free clinics, they handle all the organizational details: tables, chairs, event permits, outreach flyers. “The vets just show up, do the work and leave,” she said. “We stay in our own lanes. We don’t give medical advice, they don’t do planning and outreach, and it’s a beautiful relationship.”

As a national complement to the kind of work Weise is doing locally, the ASPCA is researching ways to lower the cost of vet care without diminishing quality. “How do we shorten diagnostic and treatment protocols?” asked Bershadker. “If the vet can diagnose more quickly with fewer tests, it’s cheaper, and if it’s cheaper it’s more accessible.” He pointed to a previous success: a technical advance in performing spay/neuter surgeries called the pedicle tie that’s allowed vets to complete the procedure in a shorter time.

Taking a broader view, Bershadker also thinks the field needs to take a cue from the legal world, which has a discipline of community-based lawyers, and find a way to make that possible for vets. “We need to create an economy around being a community veterinarian,” he said. “There’s a desire for vets to give back to their communities — we need to make it economically viable for them.” Making basic procedures more efficient is one way of doing this. More loan repayment programs for vets practicing in underserved areas like the Veterinary Medicine Loan Repayment Program are another possibility.

It’s critical that services be geographically accessible and that people are aware of them. One way to address those issues and be more efficient in general is to make use of existing institutions that already reach low-income people. One example is the ASPCA’s partnership with Food Bank for NYC to supply pet food, which in its first year has distributed nearly 100,000 pounds of dog and cat food to 254 food pantries.

“Rather than recreate the distribution system that they have perfected over time, we simply add pet food to that,” Bershadker said. “They’re happy about it because they want to serve the entire family, and we’re happy about it because the animals are getting fed.” What’s more, ASPCA puts stickers on the bags of food that inform clients about other services, so now if they need low-cost vet care, they know where to go.

Bershadker said that the animal welfare world needs to think creatively about partnerships like this with other systems such as child protective services, domestic violence services, and law enforcement. “You don’t need to rebuild the infrastructure — it exists,” he said. “You need to attach yourself to what is there.”