There is a buzz around the office this morning, and it’s not just because pumpkin spice lattes are back. It’s because this week we wonks are going to be diving into a treasure trove of new data on poverty, income, and health insurance from the Census Bureau.

Two Census reports—the Current Population Survey and the American Community Survey—are critical resources for advocates, researchers, journalists, and policymakers alike. They provide rich information on issues that impact people’s health and economic wellbeing, ranging from their living situations, to public benefits usage, to how much money they earn.

Get TalkPoverty In Your Inbox

These data, which are for 2015, inform us about what is working to cut poverty and reduce inequality, and how we might do better from a public policy perspective. Here are four key trends wonks will be examining closely:

Incomes are rising—likely for minimum wage workers, too

Some researchers are forecasting that real median household income might see the largest one-year jump in more than a decade. Low-wage workers should see a rise, too—especially in states that raised their minimum wage. This increase is particularly important for women, who make up nearly two-thirds of all minimum wage workers.

Rising wages, particularly for low-wage workers, could mean that this is the year we learn that the gender wage gap among full-time workers—which stood at women earning 79 cents for every dollar earned by their male counterparts—finally broke the 80 cent-barrier. (Not quite shattering this particular glass ceiling, but moving a step closer!)

Anti-poverty advocates will also examine these data to see if the income gains will reach families in deep poverty—those who have incomes of less than half the poverty line (approximately $12,000 annually, for a family of four).

Don’t kid yourself—racial and gender inequalities are alive and well

Any improvement in the poverty rate and the gender wage gap is critical, but we’re a long way from widespread economic equality. For example, the wage gap for women of color is severe: Last year, African American women typically earned only 60 cents, Native American women 59 cents, and Hispanic women 55 cents, for every dollar earned by their white Non-Hispanic male counterparts.

These gender and racial disparities apply to poverty rates, too. Hispanics and African Americans experienced poverty rates about 2.5 times higher last year than white Non-Hispanics. Women are also more likely to face poverty, as are individuals born in a foreign country, persons with disabilities, and single-parent families.

There is a hidden story in these data about who is more likely to be poor and paid unfairly that wonks and others need to shine a light on.

The data are seriously flawed—especially for LGBTQ people

Every year this Census release sparks conversation about how the stats themselves could be improved. Two topics come up repeatedly: The flawed way that we measure poverty and the shocking lack of data about LGBTQ people.

There is widespread agreement that the federal poverty line—$24,300 for a family of four in 2016—is far too low, which means many more Americans are experiencing serious economic hardship than are deemed officially “poor.” This disconnect isn’t surprising, considering the Official Poverty Measure (OPM) was developed more than half a century ago. A lot of things have improved since then—cars, phones, computers, Americans’ appreciation of soccer—but the OPM hasn’t, even as families’ needs and spending patterns have changed dramatically.

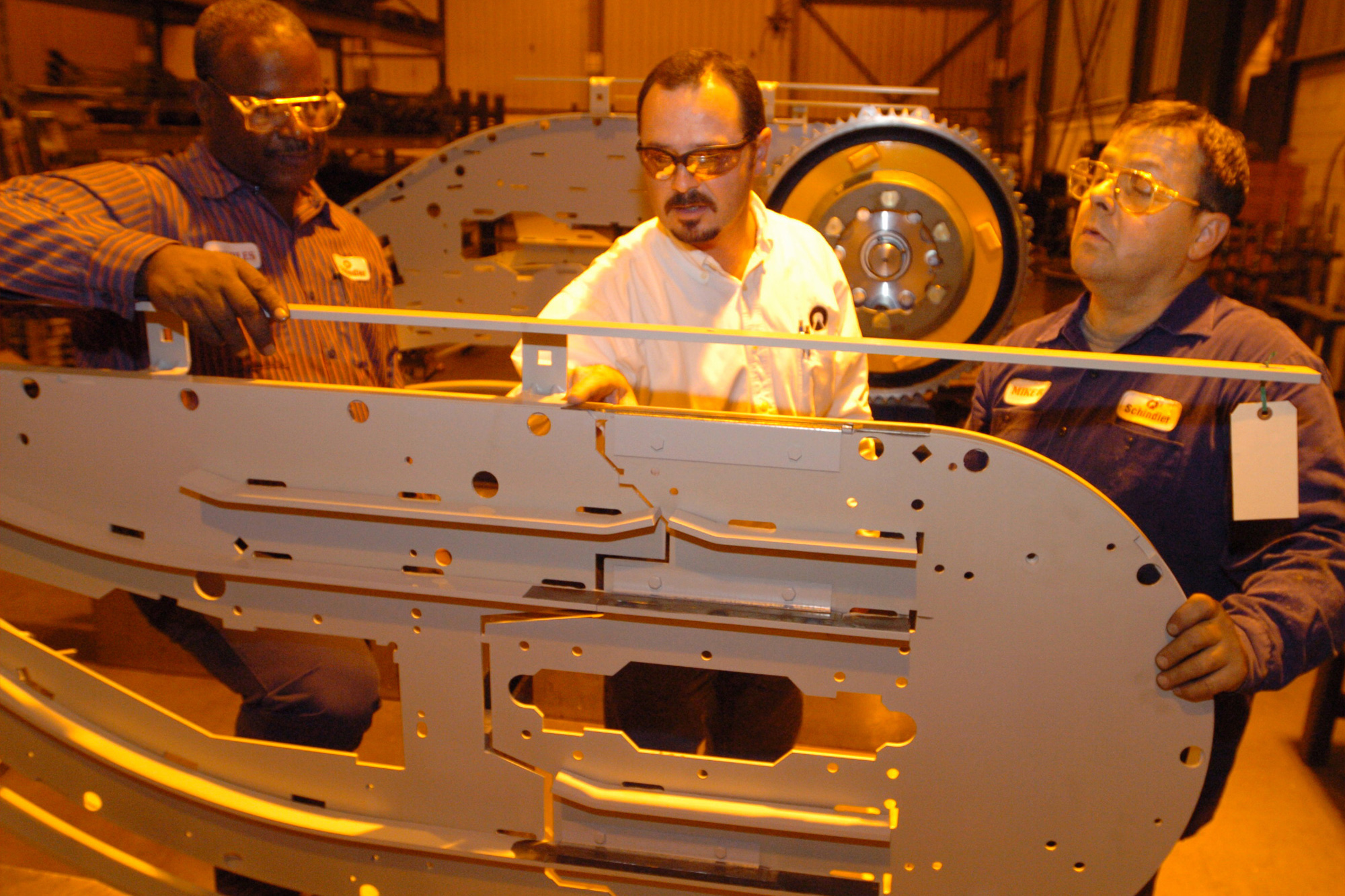

The OPM also fails to account for numerous public policies that relieve hardship. This is one reason why many wonks are fans of the Census Bureau’s alternative Supplemental Poverty Measure (SPM).

The SPM includes income households receive through assistance programs like the Supplemental Nutrition Assistance Program (SNAP), which lifted 4.7 million people above the poverty line in 2014; as well as tax credits such as the Earned Income Tax Credit and Child Tax Credit, which together lifted 9.8 million people out of poverty in 2014. The SPM also incorporates some of households’ necessary expenditures, such as clothing and utilities, and geographic variation in housing costs.

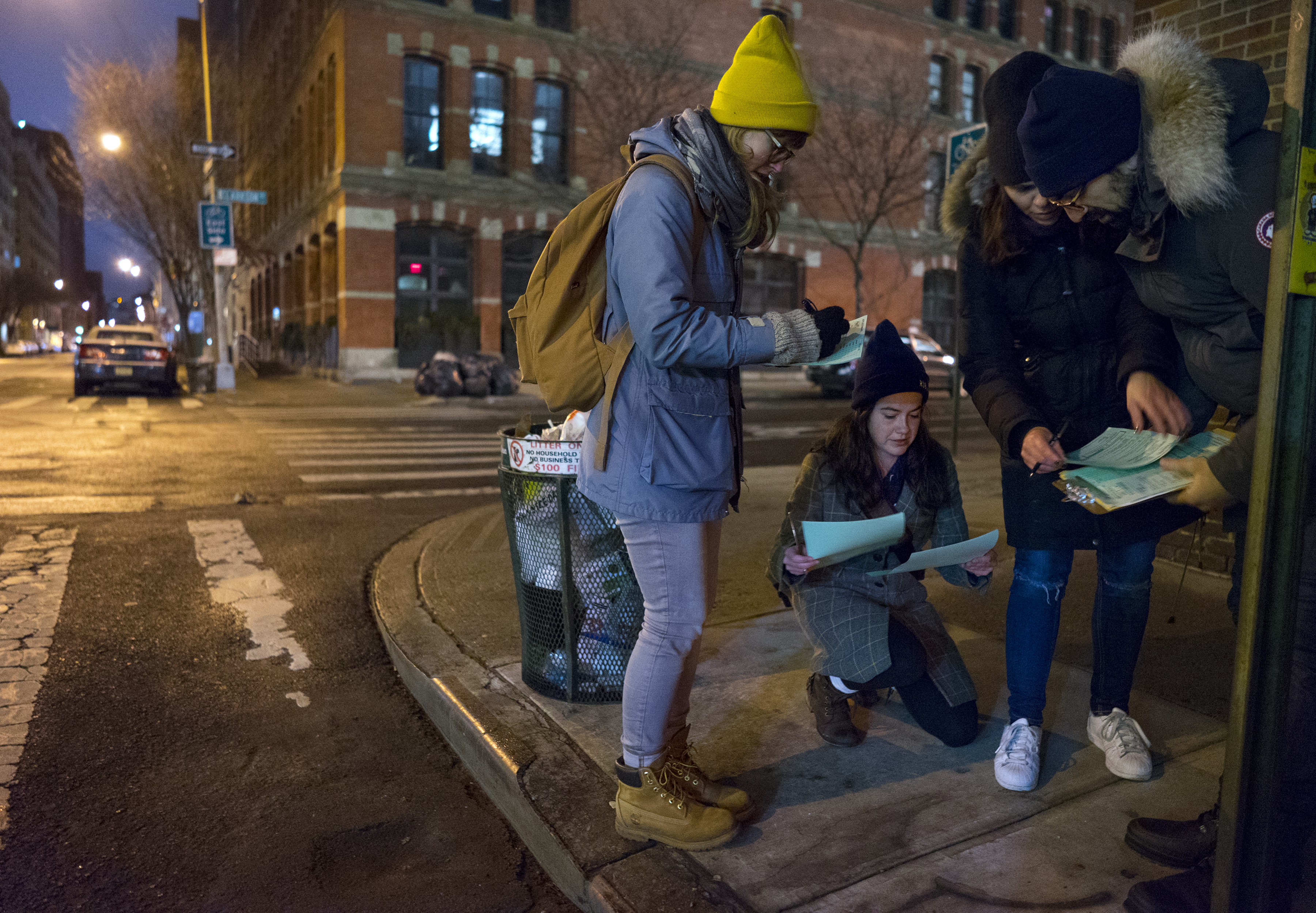

While these poverty measurements are less than ideal, they are far better than having almost no data at all—as is the case for members of the LGBTQ community. The lack of sexual orientation and gender identity data in these data sets is glaring, given that the limited data we do have demonstrate that LGBTQ individuals face higher poverty rates than many other communities. Since funding for anti-poverty initiatives often depends upon being able to show that economic need exists, this dearth of data can prevent the LGBTQ community from receiving help even when there is a clear need.

We must redouble our efforts to ensure we collect much-needed data on the LGBTQ community while also working to reform the way we are collecting and measuring poverty data.

Public policy choices reduce or exacerbate poverty, inequality, and hardship

Last year the Census data demonstrated the huge impact the Affordable Care Act had on Americans’ health care coverage, as uninsured rates fell to a historic low with declines in all 50 states and the District of Columbia. This year wonks anticipate a new low in the uninsurance rate—perhaps even below 9 percent—though it would be even lower if more states expanded Medicaid coverage.

Next week’s release will also show how other smart social programs are effectively reducing poverty. For example, last year’s SPM data revealed that without Social Security fully half of American seniors would have been poor, and that without refundable tax credits, nearly 1 in 4 children would have fallen below the poverty line as well. This evidence has fueled increasing calls from advocates and policymakers to strengthen and expand Social Security, refundable tax credits, and other key safety net programs.

Wonks look forward to continuing to assess our public policy choices based on this year’s data. We already know a lot about what to do to reduce hardship, boost economic mobility, and increase opportunity. The new Census data can help us move in the right direction—if we ask the right questions, and look for the answers.